"Top 20" MBA Programs Ranked by Applications & Yield

Jun, 24, 2008

Categories: Admissions Consulting | European Business Schools | HBS | MBA | MBA留学 | School Selection | Stanford GSB | UC Berkeley Haas

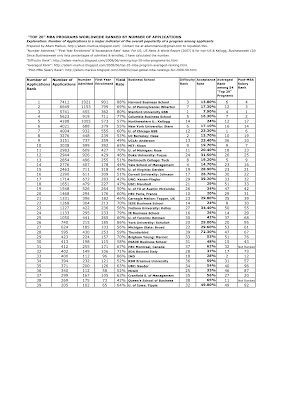

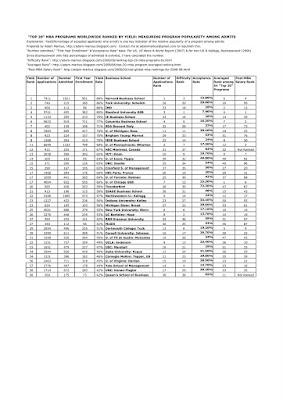

After ranking by post-MBA salary, comparing “Top 20” rankings, ranking by averaged “Top 20” rank, and ranking by acceptance rate, I thought it would be useful to rank “TOP 20” MBA by number of applications and by yield. Click here for all of my rankings tables together in one post.

Ranking by the number of applications is a crude, but clear, measure of the relative popularity of a program. While I would never suggest making application decisions based simply on what other applicants do, as I will explain below, it is quite helpful to look at the number of applications when reviewing other core admissions data (number admitted and yield).

Yield, the number of accepted applicants who actually enroll, is the single best measurement of relative program popularity among admits. As I discuss below, yield measures the behavior of admits.

Taking the 39 “Top 20” programs that provide data on their acceptance rates (see my earlier post on acceptance rates for the “Top 20 programs that did not provide such data), I put the tables below together. Click to enlarge them.

Ranking by number of applications:

Ranking by yield:

Data:

“Number Admitted,” “First Year Enrollment” &”Acceptance Rate” data: For US, US News & World Report (2007) & for non-US & Kellogg, Businessweek (2006). Since Businessweek only lists percentages of admitted and enrolled, I have calculated the number of admitted and enrolled. For sources for the rest of the data, see “Difficulty Rank”, “Averaged Rank” , and “Post-MBA Salary Rank.” The following programs were ranked:

Brigham Young: Marriot, Carnegie Mellon: Tepper, Columbia Business School, Cornell University: Johnson, Cranfield S. of Management, Dartmouth College: Tuck, Duke University: Fuqua, ESADE Business School, Harvard Business School, HEC Montreal, HEC Paris, IE Business School, IESE Business School, IMD, Indiana University: Kelley, McGill, Michigan State: Broad, MIT: Sloan, New York University: Stern, Northwestern U.: Kellogg, Queen’s School of Business, RSM Erasmus University, SDA Bocconi Italy, Stanford University GSB, Thunderbird, U. of Chicago GSB, U. of Iowa: Tippie, U. of Michigan: Ross, U. of Pennsylvania: Wharton, U. of Toronto: Rotman, U. of TX at Austin: McCombs, U. of Virginia: Darden, UBC: Sauder, UC Berkeley: Haas, UCLA: Anderson, UNC: Kenan-Flagler, USC: Marshall, Yale School of Management, and York University: Schulich.

How can applicants use these rankings?

As I have suggested elsewhere in this series of posts, when looking at any ranking, I think it is critical to look at actual market conditions. Just as average post-MBA salary reveals the market value of the degree, the number of applications reveal each business school’s ability to attract customers (applicants are customers- they are buying the right to be considered for admission) and the yield measures the rate at which a select group of customers (admits) offered the right to exercise their option for admission choose to do so. If you are going to be an intelligent investor in this market, you need to understand the market not for some abstract reason, but because doing so will enable you to determine where is best for you to apply and to go.

Yield should be evaluated in comparison to acceptance rate. Some highly ranked schools, Haas and Yale being two of the best examples, that are difficult to get into have relatively low yield rates. Obviously those admitted to Haas and Yale had other options that they chose to exercise, but more significantly it means that Haas and Yale admissions want to get who they perceive as the best students even if it means having a relatively unimpressive yield. This indicates that while the admission offices at these two schools might care about yield to some extent, they are not willing to sacrifice the quality of their potential student body in order to improve their yield. Similarly if you find a program with a high acceptance rate and a high yield, you can assume that its admits had no better options and that the admissions office was not that selective.

I think it is possible to use the yield, number of applications, and acceptance rates to a get sense of how a particular school is being used as part of a large number of applicant’s application strategy. Example: UNC Kenan-Flagler, which has a decidedly low yield (42%), receives a relatively large number of applications (1714), and is relatively easy to enter (39.2%), is a school both this data (and my own experience) tell me is being used as a “back-up school” by a significant number of applicants. Indeed, regardless of the number applications received, schools with low yields and high rates of admission should most certainly be used for the purpose of reducing the risk of total application failure.

When selecting a group of schools to apply to, use the yield and acceptance rates to put together a school application strategy that takes the level of risk into account. For more about school selection strategy, click here.

Comments? Questions? Write comments or contact me directly at adammarkus@gmail.com. Please see my FAQ regarding the types of questions I will respond to.

-Adam Markus

アダム マーカス

MBA留学 ビジネススクール カウンセリング コンサルティング MBA ランキング 合格者率